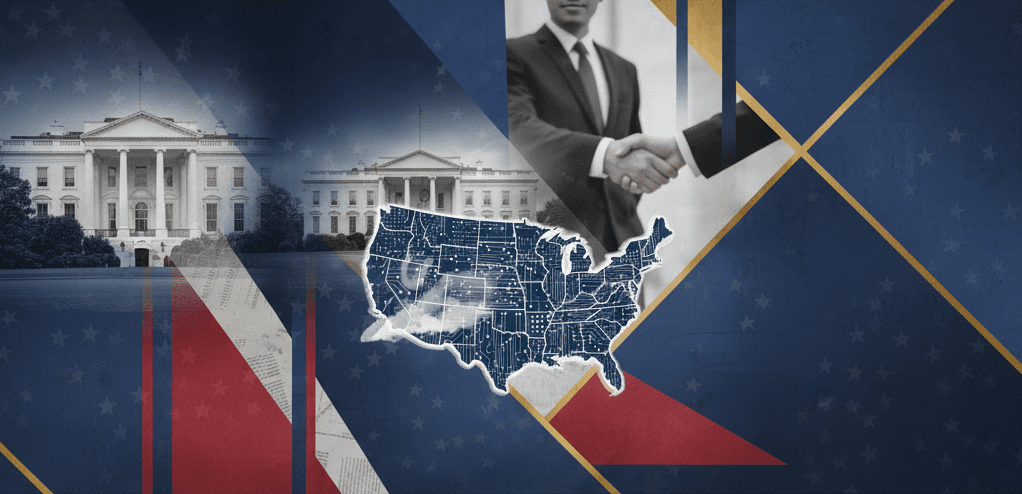

Private Company Outlook 2026 - How Policy Shifts Are Reshaping Business Strategy

How are private companies adapting to the new policy environment? Our latest analysis reveals major strategic shifts across manufacturing, energy, automotive, and infrastructure sectors as businesses recalibrate for 2026. From reshoring initiatives to supply chain reconfigurations, private companies in the $10M-$100M range are making aggressive moves. Discover which sectors show the strongest outlook and what investors are watching.